Nexans – 2022 Earnings – A record year: all-time high EBITDA, cash generation and ROCE

A Record Year: All-time High EBITDA, Cash Generation and ROCE

A Record Year: All-time High EBITDA, Cash Generation and ROCE

New Nexans Model Powering Performance and Resilience

- +12.9% organic growth compared to 2021 in Electrification businesses, driven by value

- Continued deployment of Nexans’ Electrification Pure Player strategic roadmap

- Centelsa integration ahead of plan, one acquisition announced in Electrification segments and proposed divestment of Telecom Systems activity

- Amplify & SHIFT Prime programs accelerating structural growth in Electrification businesses through more innovation and services, adding 67 million euros to EBITDA

- Record high quality and healthy 3.5 billion euros adjusted Generation & Transmission backlog1 (adjusted Generation & Transmission backlog including contracts secured but not yet enforced), up 51% versus end-December 2021, pulled by the Celtic Interconnector project

- Investment in Halden high-voltage plant capacity extension on-track

- Robust balance sheet with a net debt at 182 million euros and enhanced liquidity supporting Nexans’ strategic ambition

- Proposed dividend of 2.10 euros per share in respect of 2022, a rise of +75% from 2021

- Accelerated decarbonation: GHG emissions down -28% vs 2019, ahead of the SBTi targets

- Full-year 2023 Guidance released:

- EBITDA range of 570-630 million euros

- Normalized Free Cash Flow between 150 and 250 million euros

1 Adjusted Generation & Transmission backlog including contracts secured but not yet enforced.

Today, Nexans published its financial statements for the full-year 2022, as approved by the Board of Directors at its meeting on February 14th, 2023 chaired by Jean Mouton.

Commenting on the Group’s performance, Christopher Guérin, Nexans’ Chief Executive Officer, said: “I am pleased to report that the first year of our “Winds of change” strategic roadmap has been achieved, in full and on time. We are marking the announcement of today’s result with a record financial year in the history of the Group and I want to thank every Nexans employee who has made this possible.

We were, yet again, proven right in reaffirming our choice: “Striving to champion a global sustainable electrification”. As global grid investments soar, our Electrification businesses are up +12.9% organically, with record EBITDA performance, and all-time high adjusted Generation & Transmission backlog. Our commitment to sustainability has also paid off, with a – 28% reduction in carbon emissions since 2019 confirming that it is possible to achieve financial performance while reducing our environmental impact.

Throughout the year, we have launched and scaled-up new products and services offerings that meet the evolving needs of our customers, and improved our customer experience. The SHIFT Prime program has not only helped us achieve our financial performance, but has also positioned us for continued structural growth in the years to come.

We also made substantial progresses in the rotation of our portfolio, with the announced acquisition of REKA Cables2 (subject to regulatory approval), and our exclusive negotiations for the sale of our Telecom Systems business to Syntagma Capital.

Over the past four years, we have delivered, on time and in full, on all of our commitments, starting from our unique vision, flawless execution, powered by our unique E3 model to reconcile and combine economic performance with environmental efficiency while strengthening the engagement of our teams.

Looking ahead, we remain focused on executing our strategic plan and fully committed to contribute to enabling energy transition. We are determined to continue to deliver strong financial performance in an ever-changing business environment and to creating long-term value for our stakeholders.”

2 Subject to regulatory approval.

3 Standard copper price of €5,000/ton.

I. UPDATE ON THE 2022-2024 STRATEGIC PLAN “WINDS OF CHANGE”

a. Record year with strong profitable growth

In 2022, the financial performance was an all-time high across the board:

- Standard sales were up +6.3% organically year-on-year at 6,745 million euros in 2022, with Electrification businesses up +12.9% organically and continued scale-down of Metallurgy business in line with the Group’s strategy. Fourth quarter was up +4.9% organically compared to 2021 reflecting strong demand and positive mix/price management.

- EBITDA stepped up by +29.6% versus 2021 at 599.5 million euros, at the top of the guidance. EBITDA margin grew by +130bps against 2021 to reach 8.9% (versus 7.6%) despite the inflationary environment, reinforced by the SHIFT Prime and Amplify programs in Electrification.

- Normalized free cash-flow came in at 393 million euros, above guidance, boosted by project down payments in the Generation & Transmission segment.

- Best-in-class ROCE up +410bps year-on-year reached 20.5%, and 28.5% in the Electrification businesses.

b. Continued deployment of Nexans’ Electrification Pure Player strategic roadmap

Two acquisitions announced in Electrification segments

Following the acquisition of Centelsa in Colombia on April 1st , 2022 with integration process ahead of plan, Nexans is continuing its strategy of external growth in Electrification markets and has announced the signature of an agreement to acquire Reka Cables, subject to regulatory clearance, a Finland-based specialist in Distribution and Usages businesses. The Company has annual sales of around 160 million euros and a workforce of 270. These contribute to enriching Nexans’ global portfolio offering in important segments, and together will boost total annual current sales of companies acquired in Electrification close to 500 million euros.

In line with its strategy to exit non-electrification businesses, Nexans has entered into exclusive negotiations with Syntagma Capital, a Belgium-based private equity fund, for the sale of its Telecom Systems activity (around 680 people and 180 million euros sales in 2022). This proposed transaction marks Nexans exit from the Telecom Infrastructure and LAN cables and Systems businesses within the Telecom & Data segment.

Accelerated value growth focus through more Innovation, Digital and Services

Nexans is accelerating the development and scale-up of innovative products and solutions for its customers. The Group launched a number of new products, services and solutions, rolled out offerings geographically, and stepped up its Platinum Customers and Partners program. In 2022, Nexans had over 540,000 connected users across its digital platforms and registered more than 37,000 connected objects with ULTRACKER digital services.

The Group inaugurated in June 2022 AmpaCity, its global innovation hub dedicated to the future of decarbonized electrification, with the aim of addressing the upcoming challenges of electrification through innovation. The Group filed 75 patent applications in 2022.

c. Raising the bar on sustainability

For Nexans, sustainability encompasses continuous improvement of combined E3 (Economic, Environmental and Engagement) dimensions across the Group’s entire value chain and ecosystem. In 2022, Nexans pursued its sustainability programs:

- Nexans intensified its efforts to reduce the Group’s carbon footprint, reducing its GHG emissions (Scope 1, 2 & 3) by -28% versus 2019, ahead of targets validated by the Science-based Targets initiative (SBTi). As an example, a photovoltaic power facility on the Group’s site in Mohammedia, in Morocco, will produce more than 3,927 MWh of electricity annually and cover 19% of the plant’s energy needs.

- The Group hosted its third Climate Day in NYC to engage with its stakeholders, inspire and motivate to work together towards achieving common Climate goals and coping with raw material scarcity.

- Nexans continued to support communities suffering from power insecurity, with the Nexans Foundation celebrating its 10th anniversary in 2023 and facilitating access to an electrical infrastructure for 2.2 million people since 2013.

II. FINANCIAL PERFORMANCE

a. 2022 financial performance by segment

4 Figures at constant scope.

ELECTRIFICATION BUSINESSES: +12.9% ORGANIC GROWTH IN 2022

| GENERATION & TRANSMISSION (FORMERLY HIGH VOLTAGE & PROJECTS): Strong order intake momentum in Subsea and record backlog

Generation & Transmission recorded standard sales of 897 million euros in 2022, up +12.1% year-onyear. This achievement illustrated the contribution of the Charleston plant, the unique subsea high voltage manufacturing plant in the United States and Nexans’ two cable laying vessels Nexans Aurora and Nexans Skagerrak. EBITDA stood at 145 million euros flat compared to 143 million euros in 2021, due to changing mix of revenue in 2022.

During the period, the largest contributors were the Seagreen and Crete-Attica turnkey projects, as well as the South Fork cable supply contract in the United States.

The adjusted backlog5 reached an all-time high at 3.5 billion euros at the end of December 2022 (up +51% compared to end-December 2021), with strong visibility and 90% loaded Halden and Charleston plants until 2025. Also, throughout the period, progress was made in building the extension of Halden plant in Norway, yet another important milestone in Nexans commitment to energy transition.

5 Adjusted backlog including contracts secured but not yet enforced.

The offshore wind and interconnection market remained buoyant as it lies at the very core of the energy transition. The tendering activity continued therefore to be strong in both interconnection and offshore wind projects. Benefiting from its EPCI turnkey model positioning and strong technical and execution know-how, Nexans was recently awarded the Celtic Interconnector project between France and Ireland and the BorWin6 offshore grid connection system in Germany, reflecting the Group’s leadership and ground-breaking assets.

| DISTRIBUTION (FORMERLY TERRITORIES): Outstanding profitable growth supported by the grid renewal

Distribution sales amounted to 1,081 million euros at standard metal prices in 2022, of which 62 million euros from Centelsa. EBITDA reached 89 million euros, up +51.3% versus 2021, representing an 8.2% margin. The segment’s +12.7% organic growth was mainly value-driven and stemmed from growing grid investments across geographies. The Group’s portfolio of offers, notably ULTRACKER digital services or accessories, was solid as grid operators are investing more in Distribution to ensure grid stability, resilience and digitization.

Yearly trends6 by geography were as follows:

- Europe was up +12.2%, driven by the launch of new contracts notably in Greece and continued demand from utilities to renew and strengthen the grid.

- South America was up +6.9% in 2022 compared to 2021, reflecting expansion in sustainable electrification projects in Colombia and Peru.

- Asia Pacific was up +10.1% during the year. Australia and New Zealand delivered sound growth boosted by a recovery in demand, while China suffered from locally imposed lockdowns.

- North America was up sharply by +42.8% thanks to a still very dynamic market and Nexans’ solid positioning.

- Middle East and Africa was down -1.2% due to softer demand in Morocco, partially offset by the solid recovery in Lebanon.

6 Organic year-on-year growth – excluding Centelsa.

| USAGES (FORMERLY BUILDING): Record EBITDA margin reflecting robust demand and SHIFT programs implementation

Usages sales amounted to 1,837 million euros at standard metal prices in 2022, of which 120 million euros contributed by Centelsa. The segment was up +13.5% organically and mainly value-driven across geographies supported by the underlying urbanization and renovation trends. EBITDA reached 221 million euros, with a record 12.0% EBITDA margin evidencing continued pricing momentum in North America, management of inflationary environment, and successful transformation and deployment of solutions. The Group continued to accelerate the deployment of value-added solutions for the benefit of customers. In 2022, Nexans added more than 540,000 connected users and registered more than 37,000 connected objects with ULTRACKER digital services.

Trends6 by geography were as follows:

- Europe grew +4.4% versus 2021. The growth was supported by robust demand, new product launches and amplified solutions as well as disciplined pricing across the region.

- South America was up +3.4% during the period, with strong volumes and adequate pricing adjustments.

- Asia Pacific was up +4.7% compared to 2021, catching up in the second half of the year in all geographies.

- North America was up by a strong +37.9% reflecting strong residential market growth and continued pricing momentum.

- Middle East and Africa was up +39.5% boosted by a sustained performance in West Africa and a recovery in Lebanon and Turkey.

6 Organic year-on-year growth – excluding Centelsa.

NON-ELECTRIFICATION BUSINESSES: +9.9% ORGANIC GROWTH IN 2022

| INDUSTRY & SOLUTIONS: Profitability step-up

Industry & Solutions sales came in at 1,559 million euros at standard metal prices in 2022, up +12.3% organically year-on-year supported by (i) an outstanding performance on the back of new customer awards and robust business continuity measures in the Automotive harnesses business, (ii) continued growth in the Automation business and (iii) a robust upturn in the Mobility business. EBITDA was up +13.5% reaching 135 million euros in 2022, corresponding to an EBITDA margin of 8.6% stable compared to 2021.

Automation was up +17.8% year-on-year, with a very strong second half as well as a strong full-year performance, due to continued demand from Southern Europe and Asia, combined with encouraging results from the launch of the SHIFT program. Mobility sales were up +6.9% year-on-year thanks to a robust upturn in business and a recovery in Aerospace, offsetting Rolling Stock, impacted by the lockdowns in China. Wind Turbine activity increased by +7.8%.

Automotive Harnesses was up by a strong +22.5% organically in 2022. The robustness of sales is explained by an outstanding performance on the back of new customer awards and robust continuity measures. The long-term outlook of this business has been boosted by a major new contract for full vehicle cabling for electrical vehicles.

| TELECOM & DATA: Performance in line with 2021

Telecom & Data sales amounted to 321 million euros at standard metal prices in 2022, in line with 2021. EBITDA was down slightly at 35 million euros in 2022, reflecting the segment mix. EBITDA margin was stable at 11.0% compared to 11.5% in 2021.

LAN cables and Systems showed good momentum in North Africa while Asia was impacted by lockdowns. 2022 was a strong year for LAN products due to an improved mix, offsetting supply chain difficulties.

Telecom Infrastructure was stable compared to 2021 with European activity supported by robust demand in the United Kingdom and Germany, offsetting a slowdown in the French market.

Special Telecom (Subsea) sales were flat year-on-year. The contribution was softer in the second half of the year in line with contract completions and use of production capacities to support Generation & Transmission projects. Additionally, the order backlog was built up in the second half of the year, improving activity visibility.

OTHER ACTIVITIES (MAINLY METALLURGY): -16.3% ORGANIC GROWTH IN 2022

| OTHER ACTIVITIES

The Other Activities segment – corresponding for the most part to copper wire sales and including corporate structural costs that cannot be allocated to other segments, such as the IFRS 16 impact for lease assets not allocated to specific activities – reported sales of 1,049 million euros at standard metal prices in 2022, reflecting the decision taken by the Group to scale down external copper sales. EBITDA was -25 million euros over the period.

b. Analysis of other income statement items and net debt

Operating margin totaled 420 million euros, representing 6.2% of sales at standard metal prices (versus 4.9% in 2021).

The Group ended the year 2022 with operating income of 395 million euros, compared to 338 million euros in 2021. The main changes were as follows:

- The core exposure effect was a negative 30 million euros in 2022 versus a positive 106 million euros in 2021, reflecting lower average copper prices over the period.

- Reorganization costs amounted to 39 million euros in 2022 versus 58 million euros in 2021. In 2022, this amount mainly included costs from the conversion of the Charleston plant in the United States as well as costs related to new transformation actions launched during the period.

- Net asset impairment represented a net expense close to 0 million euro in 2022 versus an expense of 15 million euros in 2021. In 2022, net asset impairment included impairment of 14 million euros on tangible assets in Ukraine: this impairment mainly derived from the update of the discount rate used. It was offset by two reversals in Brazil and in the U.S. entity Amercable for 7 million euros each. In 2021, impairment losses of 15 million euros were recorded relative to tangible assets in Lebanon.

- Net gain on asset disposals amounted to 54 million euros in 2022, mainly related to the sale of a real-estate in Hanover, Germany, with a net impact of 55 million euros.

- Other operating income and expenses represented net income of 46 million euros, compared with a net expense of 9 million euros in 2021. The main items are the net asset impairments and the net gain on asset disposals mentioned above.

Net financial expense amounted to 57 million euros in 2022 compared with 101 million euros the previous year. The improvement was due to the impairments booked in 2021 for 51 million euros, notably in Lebanon. In 2022 net financial expense included the negative hyperinflation impact from Turkey for 5 million euros.

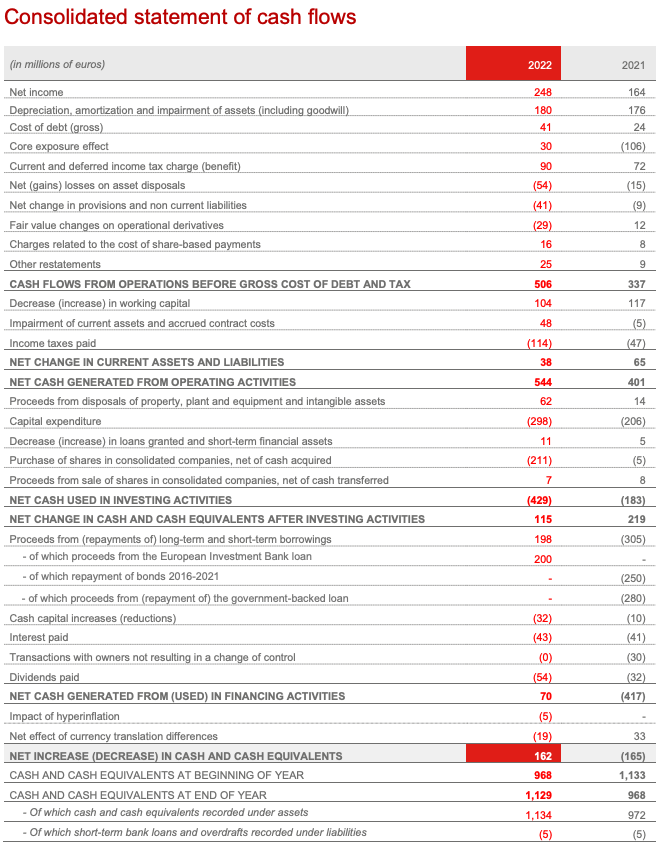

The Group’s net income came in at 248 million euros in 2022, compared to 164 million euros in 2021.The 2022 figure corresponded to 339 million euros in income before taxes (versus 237 million euros in 2021). Income tax expense stood at 90 million euros, higher than the tax expense of 72 million euros in 2021, in line with increased income before taxes.

The Group ended the year with record attributable net income of 245 million euros versus attributable net income of 164 million euros in 2021.

At the Annual Shareholders’ Meeting, the Board of Directors will propose paying a 2022 dividend of 2.10 euro per share, up +75% compared to 2021 dividend of 1.20 euro per share.

Net debt increased to 182 million euros at December 31st, 2022, from 74 million euros at December 31st , 2021, reflecting:

- Cash from operations of +451 million euros;

- A 152 million euros positive change in working capital in relation to the positive impact of cash collection in the Generation & Transmission business in 2022; o Reorganization cash outflows of -59 million euros;

- Capital expenditure of -298 million euros, a significant portion of which related to the strategic investments made at Halden plant in the Generation & Transmission business;

- Net cash outflows of -255 million euros for M&A operations, of which mainly -258 million euros for the acquisition of Centelsa in Colombia; o Investing flows of +73 million euros of which +60 million euros for the sale of real estate in Hanover;

- Cash outflows of -134 million euros related to financing and equity activities, including interest payments of -48 million euros, the Group dividend payment for -54 million euros and the buyback of Nexans own shares for -65 million euros in view of (i) the employee share ownership operation and (ii) long-term incentive plans. These items were partly offset by the capital increase in relation with the employee share ownership operation, which had a positive impact of +33 million euros;

- Other items include a -24 million euros negative impact corresponding to new lease liabilities and a negative impact of -15 million euros for foreign exchange fluctuations during the year.

III. SIGNIFICANT EVENTS SINCE THE END OF DECEMBER

February 6 – Nexans has entered into exclusive negotiations with Syntagma Capital, a Belgium-based private equity fund, for the sale of its Telecom Systems activity.

February 7 – Nexans signed a back-up line of financing on February 7th, 2023 for an amount up to 325 million euros. This line of financing will enable the Group to secure its liquidity and ensure the refinancing of the two bond issues maturing in 2023 and 2024. This facility will mature on August 7th , 2025.

IV. 2023 OUTLOOK

The energy transition is no longer a question, it is an answer to the challenges facing the world. Nexans will play a key role as the answer will rely on a sustainable electrification of the planet that is safer, decarbonized and accessible to all.

Nexans has the capacity to face the uncertain macro environment. The Group has acquired the ability to be agile, anticipate and quickly adapt to unprecedented circumstances and is now reaping the benefits of several years of transformation, while allowing for further improvement. Nexans will continue to pursue its strategy focused on value growth over pure volume, to keep unleashing profit from its unique transformation platform, as well as its investments in the growing Generation & Transmission markets. Nexans is only at the beginning of its move towards premiumization through the development of value added systems and solutions for its end-users.

In this context, in 2023 Nexans expects to achieve, assuming no conjunctural effects upside and excluding non-closed acquisitions and divestments:

- EBITDA between 570 and 630 million euros;

- Normalized Free Cash Flow7 between 150 and 250 million euros.

7 Free Cash Flow excluding strategic capex, disposals of property, plant and equipment, impact of material activity closures and assuming project tax cash out based on completion rate rather than termination.

A webcast is scheduled today at 9:00 a.m. CET. Please find below the access details:

Webcast

https://channel.royalcast.com/landingpage/nexans/20230215_1/

Audio dial-in

- International switchboard: +44 (0) 33 0551 0200

- France: +33 (0) 1 7037 7166

- United Kingdom: +44 (0) 33 0551 0200

- United States: +1 212 999 6659

Confirmation code: Nexans

Appendices T

The audit procedures have been carried out and the Statutory Auditors’ report is being issued.

Source

Nexans

EMR Analysis

More information on Nexans: See the full profile on EMR Executive Services

More information on Jean Mouton (Chairman of the Board of Directors, Nexans): See the full profile on EMR Executive Services

More information on Christopher Guérin (CEO, Nexans): See the full profile on EMR Executive Services

More information on Jean-Christophe Juillard (Deputy CEO & Chief Financial Officer, Nexans): See the full profile on EMR Executive Services

EMR Additional Notes:

- Major financial KPI’s since 2017 are available on EMR Executive Services under “Financial Results” and comparison with peers under “Market Positioning”

- Companies’ full profile on EMR Executive Services are based on their official press releases, quarterly financial reports, annual reports and other official documents like the Universal Registration Document.

- Specific attention must be set when comparing the results over years as Nexans changed the weight of their results with a Copper price per ton from € 1’200 in 2019 and 2018 to € 5,000 in 2020, 2021 and 2022.

- The Nexans FY 2022 Earnings Presentation can be found here: https://www.nexans.com/en/finance/Financial-results.html

- The Nexans FY 2022 Consolidated Financial Statements can be found here: https://www.nexans.com/en/finance/Financial-results.html

- The Nexans Universal Registration Document 2021 can be found here: https://www.nexans.com/en/finance/Regulatory-information.html